To view tax dissections in MDS:

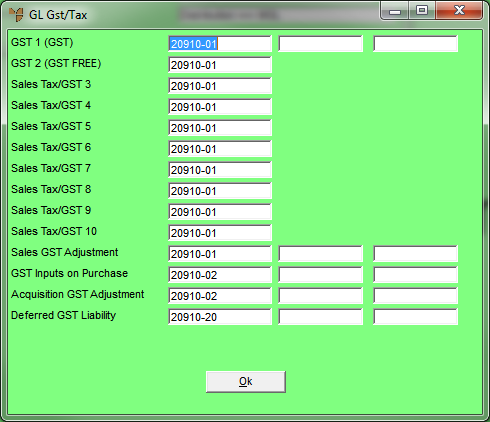

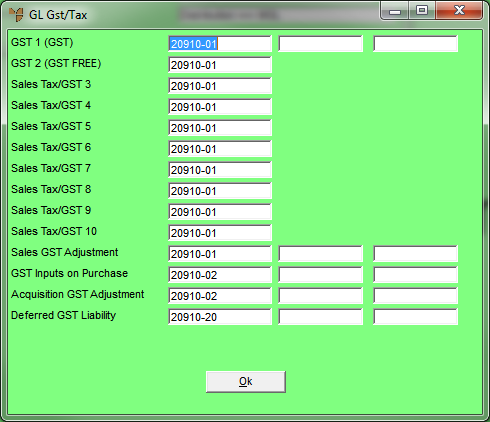

Micronet displays the GL GST/Tax screen.

|

|

|

Technical Tip A GST Description can be set in the Company Maintenance to change “GST” to another tax label such as “VAT” for example. Where this is set, all references to GST would appear as VAT. |

|

P&L B/S |

GL Interface Account |

Description |

|

B/S |

GST 1-10 |

Credited when creating a sales invoice Debited when creating an adjustment (credit) note |

|

B/S |

Sales GST Adjustment |

Debited when giving on time discounts Debited when decreasing a debtor account by debtor journal Credited when increasing a debtor account by debtor journal |

|

B/S |

GST Inputs on Purchase |

Debited when receiving goods Credited when entering a credit for goods received Debited when receiving imports Credited when entering a credit for imports Debited in the current period when receiving imports with Deferred GST |

|

B/S |

Acquisition GST Adjustment |

Debited when increasing purchase values Credited when decreasing purchase values |

|

B/S |

Deferred GST Liability |

Credited in the current period when receiving imports with Deferred GST |